FOREVER ENJOY THE FRUITS OF YOUR LABOR

BY USING INSURANCE CONTRACTS ON YOUR RETIREMENT FUNDS

Exclusively for:

A. EARNINGS SECTION

A1. EARNINGS and Budget

A2. EARNINGS Definitions

A3. EARNINGS Emotional Considerations

EXTRA: The $$$ Costs of No, Not Yet, Maybe

A1. Consider Using Your EARNINGS Annuities Instead to Meet Your Budget

Withdrawals Above 10% will spell the end of safe high fixed rate investing. Why? Click Here

GREEN means your budget is covered, RED not so much

This only means that you will have to reduce expenses, augment means, start income later, amongst other things.

Notice in the WITHDRAW RATE ROW that once the 10% threshold is crossed, you are now withdrawing more than the institution annually allows. This is the challenge with aging in an inflationary world; eventually your liquidity needs exceed the liquidity parameters of any institution offering high fixed rates.

As a consequence, you will typically seek shorter term investments in these years, offering lower yields, but providing more liquidity, all the while expediting the diminishment of funds.

To IGNORE this concept is to participate in the "BOILED FROG" scenario....Don't Do It!

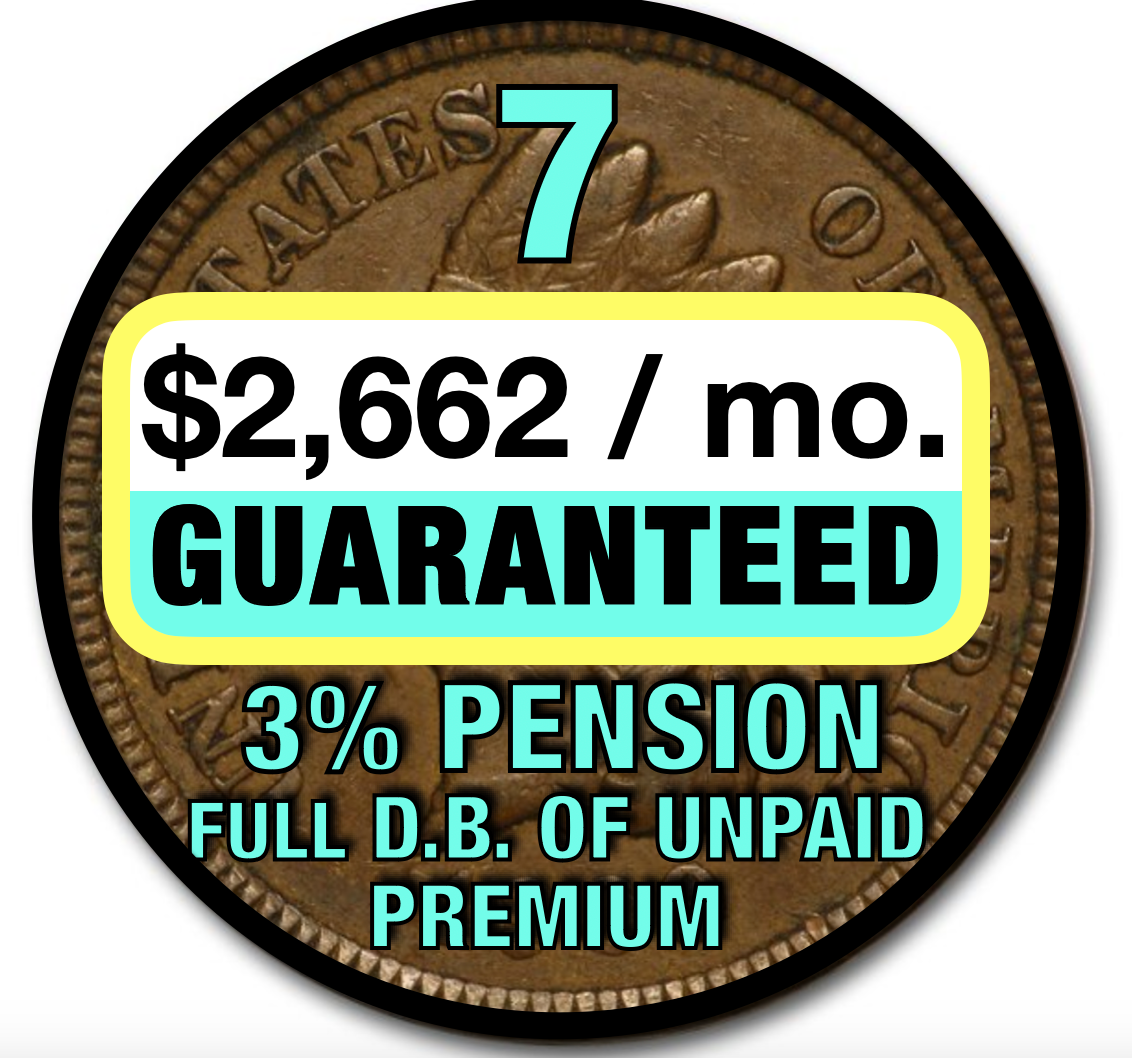

THIS IS THE REASON WHY INCOME ANNUITY PLANS WERE INVENTED

(the 6 income coins below)

A3. Defining How Each of These

EARNINGS GUARANTEE TYPES Will Work

A4. Emotional Considerations Regarding EARNINGS Plans

The Plan You Choose May Be Based on a Variety of Factors

GREEN means your budget is covered,

RED not so much

This means you must reduce expenses, augment means, start income later, utilize other funds, combine plans

B1. INCOME and Budget

B2. INCOME Definitions

B3. INCOME Emotional Considerations

B4. INCOME Combo Plan (sample)

EXTRA. $$$ Costs of No, Not Yet, Maybe

B1. Your Income Values and Budget

And...Where ARE You Going to Find these Cash Flow Rates ?

B2. Income Definitions

Scroll to the right if using this calculator on your cell phone

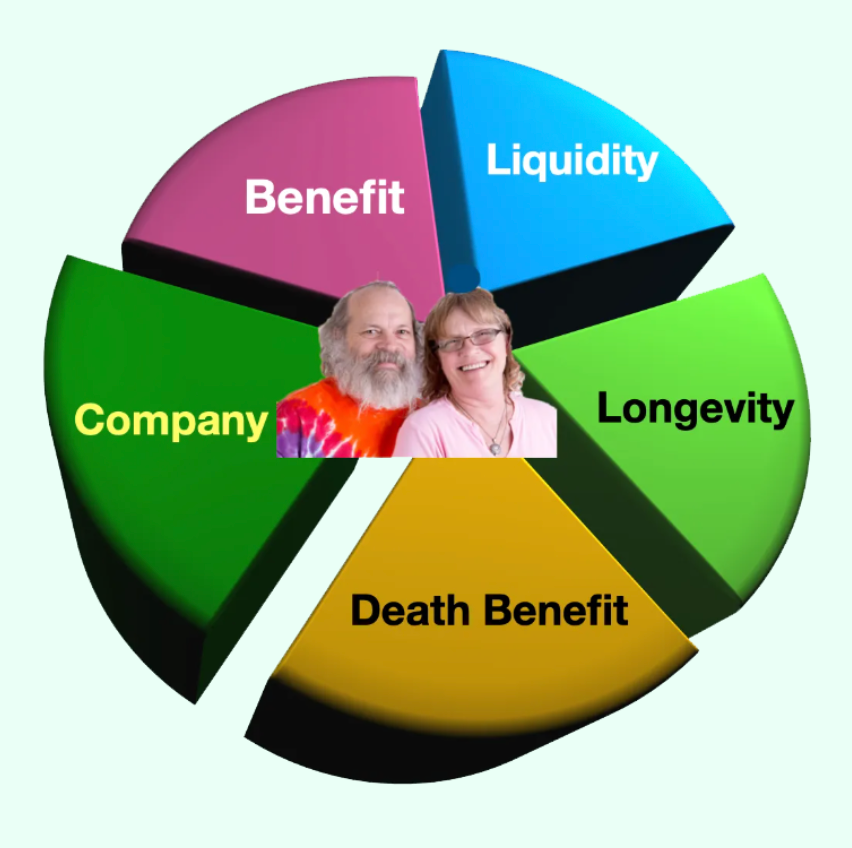

B3. Emotional Considerations Regarding Income Plans

The Plan You Choose May Not Always Be the One that Looks the Most "Numerically Profitable"

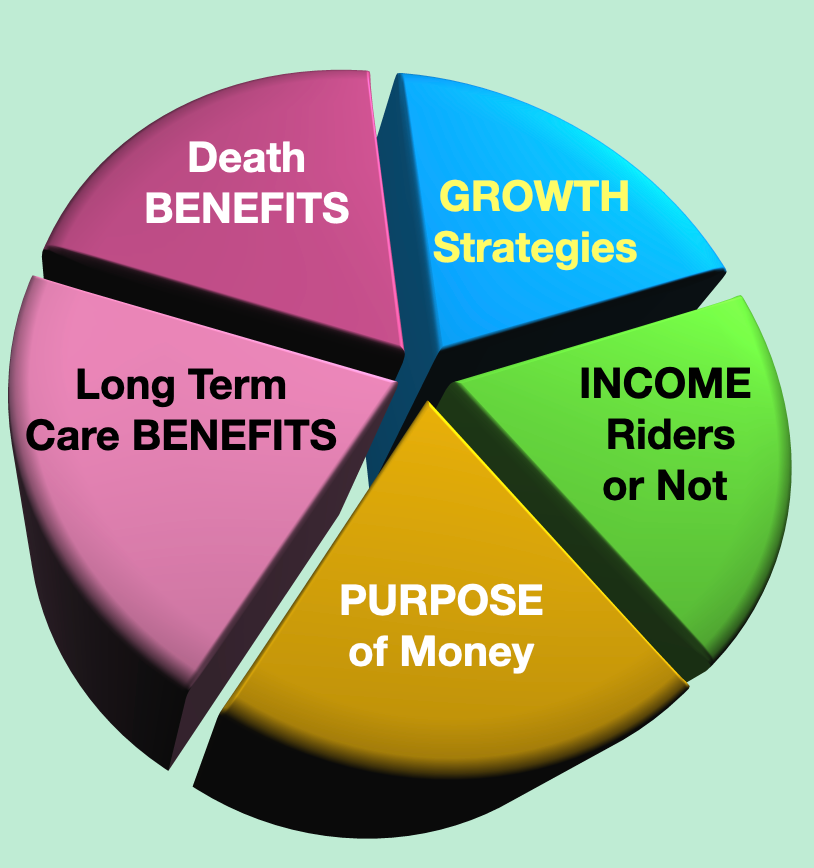

"Cerebral Analysis"

determining the best mathematical bang for your buck over 25 years of retirement (no expenses)

"Emotional Analysis"

determining your comfort level with 5 facets

B4. Example of Jonny Sample Using a Combo Plan of Various Income Annuities

Withdrawing CERTAIN income from an UNCERTAIN portfolio is a problem WAITING to happen

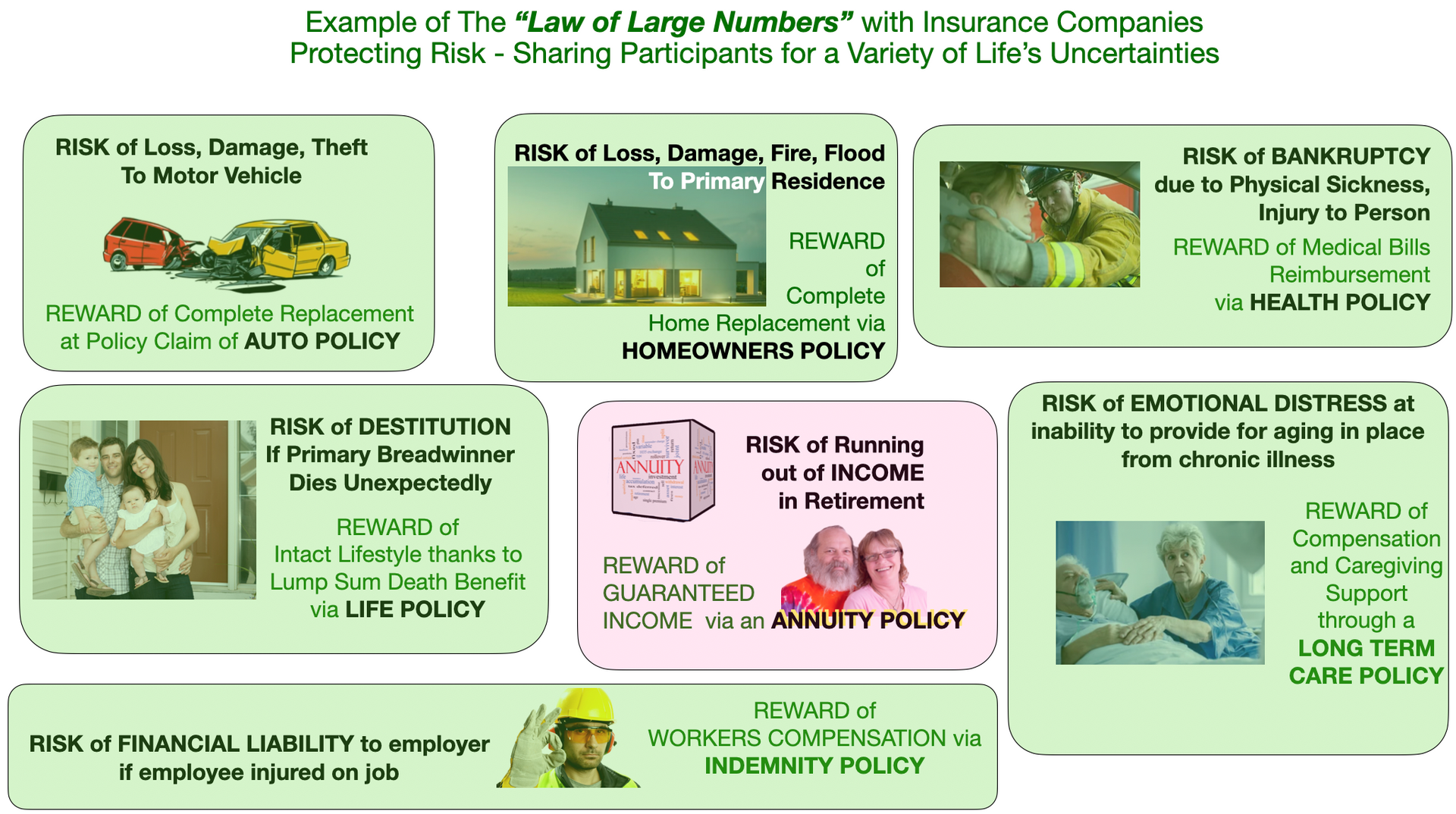

(2) Risk of MISSING OUT on the Industry's Unique Benefit of "Mortality Credits"

Insurers Offer One-of-a-Kind Possibilities to Obtain Above - Average Income Benefits Via "Risk-Sharing" (see definition at right)

Sharing the "Risk of Running Out of Income" via an Insurer Makes All the Difference for an Enjoyable Retirement !

Additional Examples of Risk Sharing from the Insurance Industry

(click below)

Need a Break from Studying Financial Matters ? (I Don't Blame You)

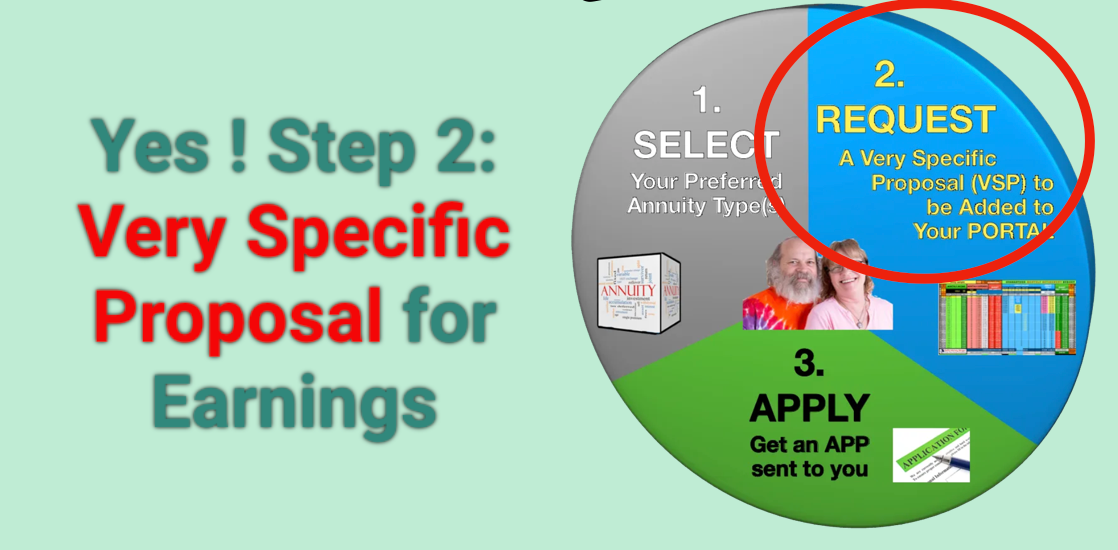

Well - YOU MADE IT ! And..You are surely SMARTER about YOUR annuity benefits than the average annuity shopper at this point.

Good Studying! For a .pdf of your quote, click here. For a more specifically tailored strategy proposal (Quote #2), click here

Or you can call or text me at 949 500 5478 (always a good idea to text me first)

Or here is my email: jim@safemoneysinger.com

Jim

The Safe Money Singer