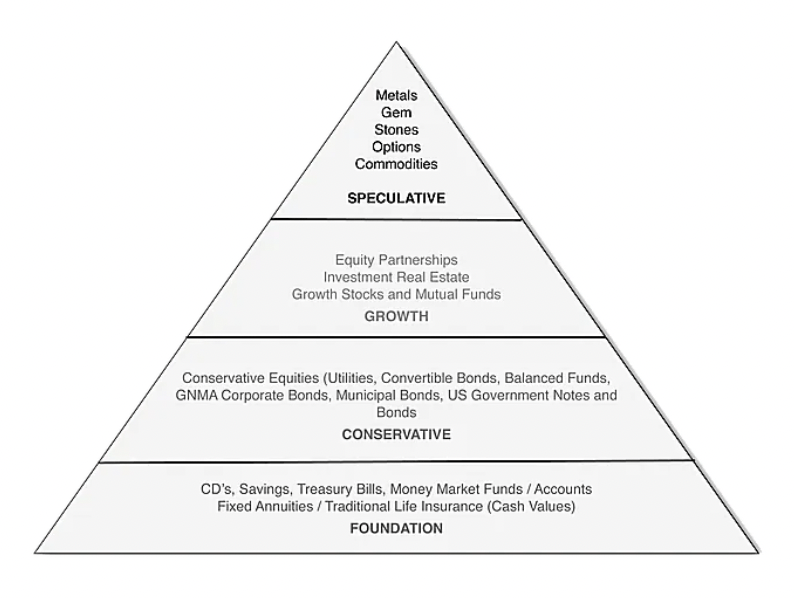

PYRAMID OF SAFETY

By James Alden

In the "Pyramid of Safety" Matrix..

Annuities are the Foundation Stones

These laws keep insurers very safe when compared to other forms of financial instruments. Insurers must make regular reportings to the state.

Think about this for a moment.

Instead of your funds being subject to pure helter skelter market forces, there are laws that require minimum levels of fiduciary responsibility on an insurance company's part.

The main reason why annuities are at the foundation of the "Pyramid of Safety", as shown to the right here, is because by definition they are legal contracts that are enforced by the state in which the company does business.

A third consideration regarding the safety of an insurance company is the idea of re-insurance. Since insurers set aside reserves to uphold the guarantees written in the contracts they sell, in some cases they may choose to purchase an insurance policy from another insurance company in order to reduce exposure to loss. This is known in the business as reinsurance. Often these reinsurance arrangements are disclosed in the company's brochures and marketing material, so it is worth finding out (especially if you have a lower rated company) if there are any reinsurance agreements in place .with your company

Finally, there is also a State Guaranty Fund which also protects consumers in the rare occurrence of an insurer not being able stay sufficiently solvent. This guarantee fund is usually a used as a last resort since normally an insurer would simply change hands to another larger company in the event of a pending insolvency. Insurance companies pay annual premiums to the State Guarantee Fund that can accumulate and remedy any potential insolvencies in the future.

There are, however, limits on how much money the Guaranty fund will protect policy holders and these limits vary state by state. There is a great source of information on the various guaranty associations right here: https://www.nolhga.com/

By the way, the State Insurance Departments not only regulate insurance companies, they also regulate insurance agents, and in some cases, agents are prohibited from even mentioning the existence of the Guarantee Association. The reason for this is that a consumer must be encouraged to choose an insurer not based on the existence of the Guarantee Fund, but on the "claims paying ability" of the insurer, often indicated by the various rating agencies. So always study the ratings to help you choose your insurer. Do not rely on the existence of the Guarantee Fund.

So on to the anecdotal proof of how safe insurers are and how that safety compares, say, to their main market rival, "El BANCOS" !

The FDIC website actually publishes the (ongoing) list of failed banks in this country. As of this writing, there were over 500 since the year 2000.

The Weiss Rating Agency also compiles an ongoing list of failed banks, credit unions and insurance companies on their website. Here is their list of failed insurers . Keep in mind, as of this writing (May 2020), I counted only about 39 life and annuity carriers (since the referenced list includes health care companies, property casualty companies etc.)