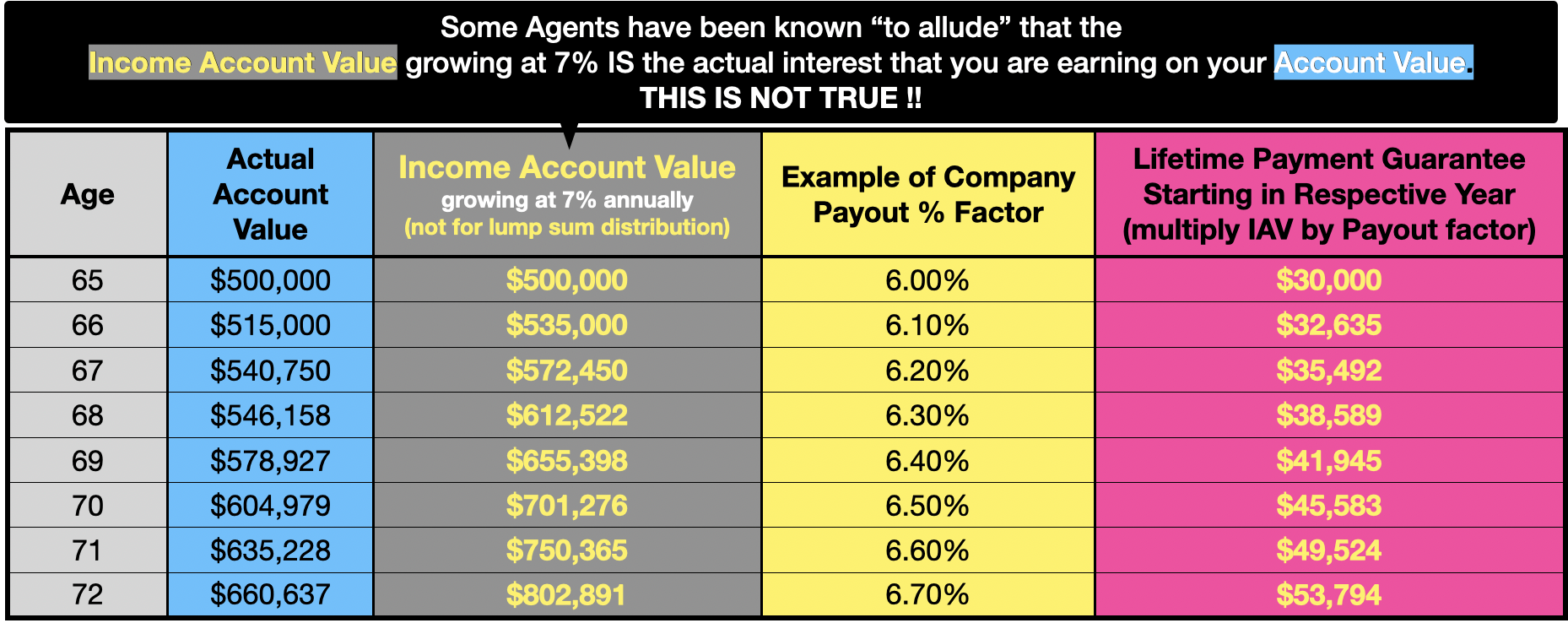

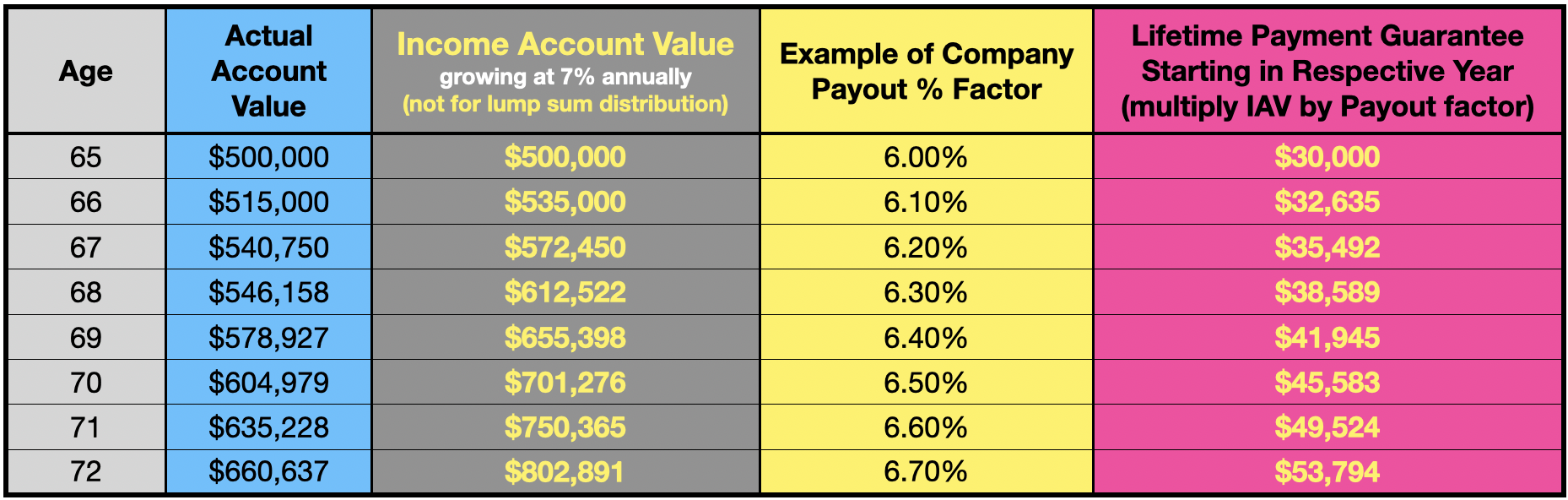

You can see in the far right hand column above exactly what the insurer would guarantee you for a lifetime payment if you started in that particular year. All you do is multiply the payout factor by the value in the Income Benefit Base (or Income Account Value). This is a lifetime payment regardless of how long you live, and it is the virtue of income rider on an equity indexed annuity.

Now, now you can see how the agent offering the annuity can speak of several different "rates of return".

- The "rate of growth" in the Benefit Base (Income Account Value) showing the annual guaranteed growth rate.

- The "withdrawal rate" in the ledger from the insurer which is based on your age, or joint age with spouse.

- The "payout Rate", which is simply dividing your lifetime income amount by the original principal (yielding a fairly attractive percentage anywhere from 5% to 9%).

Here's the problem. You thought you were getting a guaranteed 7% rate of return on your money, but are you really? The real rate of return on your annuity is reflected in the accumulation value, not the income value. The accumulation value is not shown in the chart above. As discussed, the income value is fictitious and not a real lump sum of money — not ever.

In the heated environment of the sales transaction, it may not have come across that way. The rate of interest you are earning on your principal has to do with whatever index or interest choice your agent discussed with putting you into; whatever was available at the time.

Many clients do not realize this until way down the road and they find that their principal is declining because they are taking out more than they are earning, when in fact they were led to believe that their principal could never go down. The agent should have clarified that your principal will never go down due to the market failing,

but it certainly can decline if you take out more than you are earning.

This is a rather disingenuous way of selling the annuity, and it is rampant. If there was a guaranteed 7% rate of interest currently in the market, I would be a very, very, very busy man. As it is, I may not be as busy as my fellow "line-blurrers", but a guaranteed 7%, 8% or 9% rate of return, of course, does not exist — at least not right now!

By the way,

an income rider should only be chosen by an annuity buyer that is genuinely concerned about an income stream much more so than he /she is cornered about the accumulation of capital. The reason for this is because the income often exceeds the interest that is being earned your money.

On the other hand, you can see that in the chart above, that if you do have longevity concerns, the lifetime payment option, especially if you can put it off (defer from taking lifetime income) for a long while, becomes quite valuable in terms of how much money you get back, the longer you live.